Demand generation for hotels

The hospitality industry often debates whether hotels can actively generate demand or if their role is primarily to capture existing demand more effectively than their competitors.

The hospitality industry often debates whether hotels can actively generate demand or if their role is primarily to capture existing demand more effectively than their competitors. While most hotels operate within the constraints of demand generated by external factors, there are exceptions—hotels and hospitality brands that have managed to shape demand rather than just respond to it.

A huge thank you to Pedro Calvo for crafting the post

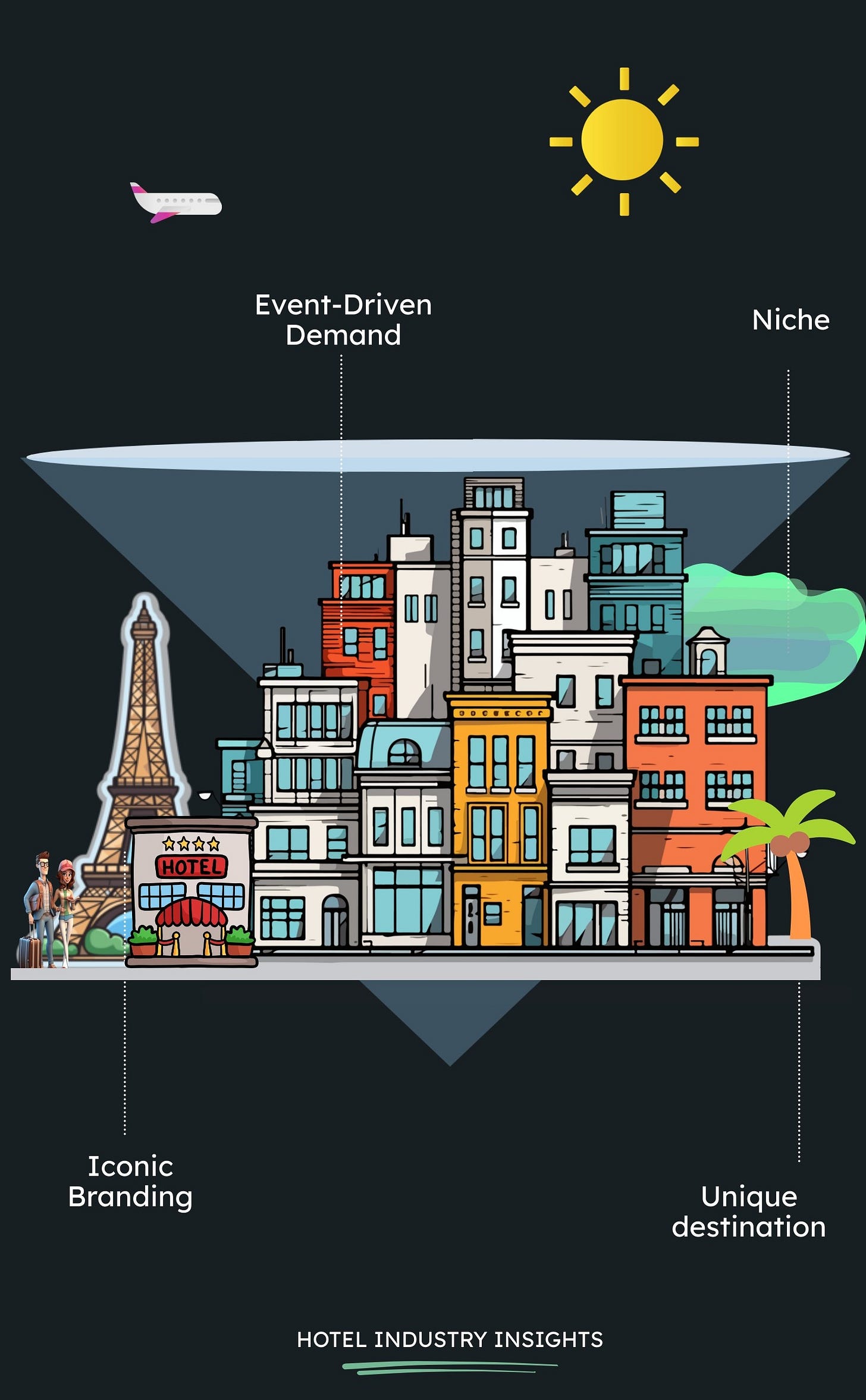

Exceptional cases:

While most hotels do not directly create new demand, a select few have managed to become demand generators themselves. This is typically achieved through:

Iconic branding – Disney resorts are a prime example. Disney doesn’t rely on a city’s tourism to fill its hotels—it creates a tourism ecosystem where the hotel is an integral part of the experience.

Unique destination creation – Resorts like Atlantis in the Bahamas or Marina Bay Sands in Singapore have become destinations themselves, attracting visitors who travel specifically for the hotel experience.

Event-driven demand – Some hotels create demand by hosting major events that attract international travelers, such as conferences, concerts, or sporting events. Examples include Las Vegas hotels tied to major casino tournaments or fashion week events in luxury hotels in Paris and Milan.

Extreme niche positioning – A hotel can generate demand by tapping into a very specific audience. Ice hotels, underwater suites, or themed hotels like Finland’s Kakslauttanen Arctic Resort (where travelers go to see the Northern Lights) attract guests who wouldn’t otherwise travel to that location.

For most hotels, however, demand is not something they create—it is something they compete to capture. The key is understanding the landscape of demand generators and using them to your advantage.

"Top-tier hotels don’t wait for demand, they create it, capture it, and convert it before the competition wakes up."

Demand generators: Who creates tourism demand?

Hotels function within a broader ecosystem of demand, shaped by powerful external factors. Understanding these demand generators allows hotels to align their strategies to maximize exposure and direct bookings.

1.- Influencers/Media

Media exposure can single-handedly transform a destination’s demand. This includes:

Screen tourism – When entertainment drives travel demand

The power of media in shaping travel trends is undeniable. Tourists are increasingly choosing destinations they have seen on screen, whether in movies, TV series, or YouTube documentaries.

Netflix’s Emily in Paris significantly increased tourism in the French capital, particularly among younger travelers drawn to the city’s romanticized depiction. Hotels and cafes featured in the show saw a spike in visitors.

📌 Viral travel content – When social media dictates destinations

Platforms like TikTok, Instagram, and YouTube have become the new travel agencies, inspiring millions of users to visit places that suddenly go viral.

✅ Example: MrBeast’s Egypt Visit: After MrBeast (one of YouTube’s biggest creators) documented his trip to Egypt last week, Google searches for "travel to Egypt" and "best hotels near the pyramids" spiked dramatically. Hotels in the area reported increased direct inquiries and bookings.

🔹 Hotel Strategy: Monitor viral travel trends on TikTok & Instagram (I also like to use Google Trends) and create rapid-response marketing campaigns. If a landmark near your hotel goes viral, run geo-targeted ads, offer influencer stays, and create local experience packages to attract those inspired by social media.

2. Destinations: The foundation of tourism demand

A destination is the single most influential factor in driving tourism demand. Travelers don’t book hotels—they book experiences, cultural moments, and unique destinations first, and accommodation follows. According to industry data, up to 80% of travel decisions are influenced by the attractiveness of the destination itself, including landmarks, special events, gastronomy, and government-backed tourism initiatives.

3. Airlines & tour operators: The traffic controllers

Airlines and tour operators act as traffic controllers, shaping where, when, and how many travelers arrive at a destination. Their decisions on new flight routes, package deals, and seasonal promotions can make or break hotel demand in specific markets.

How they influene demand:

Expanding flight routes unlocks new tourism markets, making previously overlooked destinations suddenly accessible and desirable.

Bundled travel packages (hotel + flight + experiences) reduce friction for travelers, making it easier to choose a destination and driving group and family bookings.

Real-world impact:

Iceland saw a 400% increase in inbound tourism after low-cost airlines expanded transatlantic routes, making it a prime layover destination.

Maldives resorts experienced record occupancy rates following new direct flights from Europe and Asia, cutting travel time and increasing accessibility for high-value tourists.

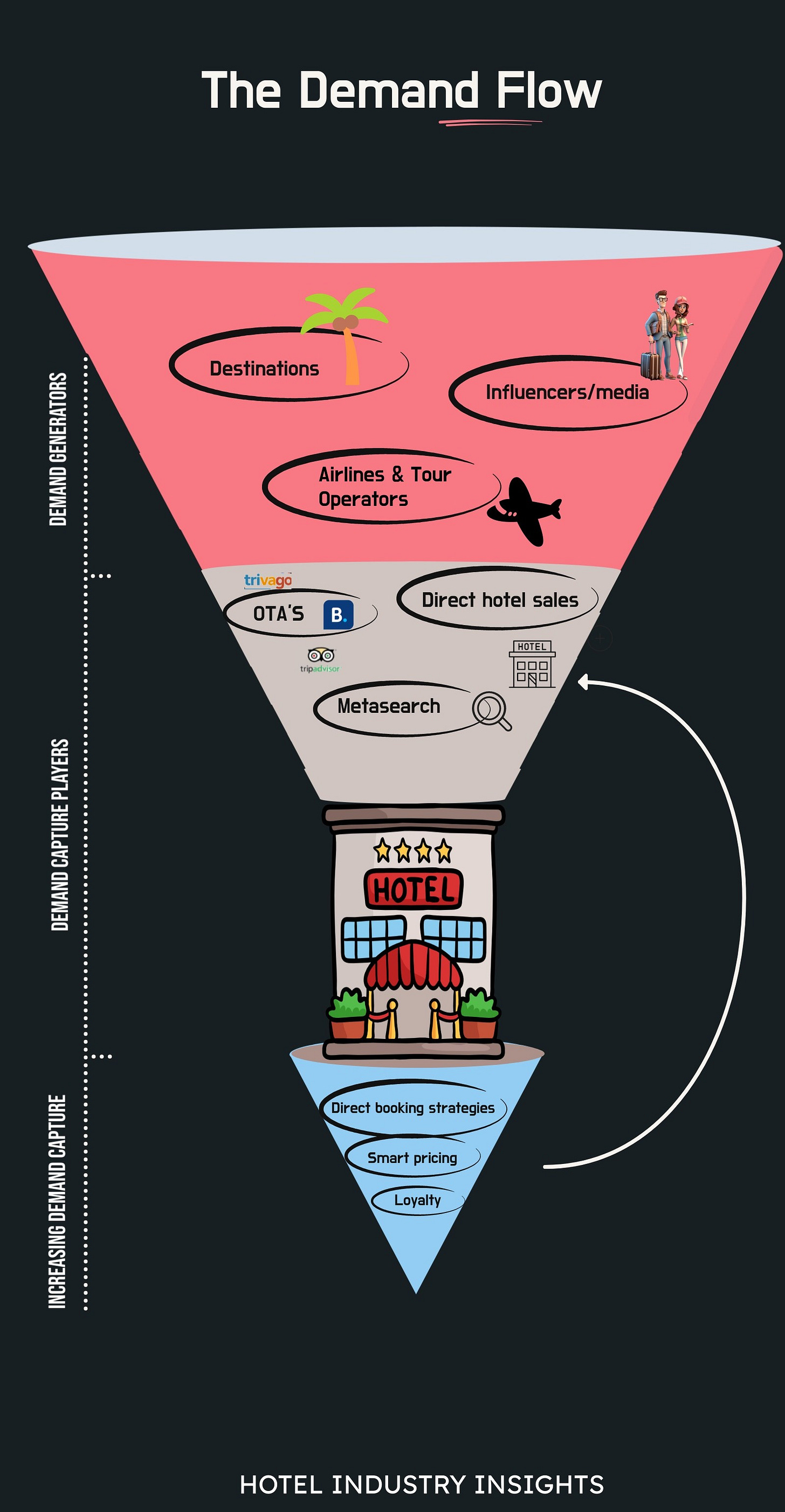

Generated demand vs. Demand capture: Where hotels compete

Once demand is created, it moves into the capture phase, where hotels, OTAs, and other channels compete to convert interest into bookings.

Demand capture channels: The battleground

1. Metasearch Engines – The Digital Billboards

Metasearch platforms (Google Hotel Ads, Trivago, Kayak, etc.) are critical battlefields for demand capture, allowing hotels to compete directly against OTAs for bookings. However, simply being present is not enough—strategic bidding and pricing optimization determine whether your hotel secures the booking or loses it to an intermediary.

1. Optimize your metasearch presence with competitive pricing

Many hotels assume that just listing their direct rates on metasearch will automatically drive bookings. In reality, OTAs have advanced strategies to win the click, and hotels need to actively compete with:

✅ Rate parity

Ensure your direct channel pricing is competitive with OTAs.

Use geo-targeted pricing (e.g., offering exclusive lower rates in specific markets where OTAs dominate).

✅ Enhance visibility with free & Paid listings

Google free booking links: If you are not using this, you're leaving free traffic on the table. Ensure you are listed in the free section below paid results in Google Hotel Ads.

Trivago & Kayak sponsored listings: These boost direct visibility in competitive markets (important to be visible before a user clicks on “see more”)

🎯 2. Advanced bidding strategies: How to beat OTAs at their own game

Bidding on metasearch is not one-size-fits-all. Successful hotels customize their bidding strategy based on:

📌 a) Device-specific bidding (Desktop vs. Mobile)

Mobile-first demand is rising, yet many hotels still bid for desktop.

Reduce desktop bids slightly if mobile has a higher conversion rate.

Prioritize mobile bids for last-minute bookings and same-day check-ins.

Use mobile-exclusive direct booking perks (e.g., mobile check-in, app-only discounts).

If 70% of your direct bookings come from mobile, shift 20-30% more of your budget to higher mobile bid adjustments to secure those users.

b) Adjusting bids based on length of stay (LOS)

OTAs often bid aggressively for shorter stays because they bring in quick (and multiple)commissions.

Hotels can strategically increase bids for longer stays, which provide better revenue per acquisition.

Lower bids for 1-night stays if data shows that OTAs are dominating that segment.

If your hotel’s RevPAR is highest for 4+ night stays, increase your bid 20-30% for searches including stays of 4+ nights while lowering bids for single-night stays.

c) Bid differently by booking window (Early vs. last-minute)

Higher bids for last-minute bookings: Guests booking same-day stays are high-intent, low-research customers—they are more likely to book direct if the rate is right.

Lower bids for early bookings (30+ days out), where OTAs may offer non-refundable rates.

Test bidding increases for 7-14 day booking windows—the sweet spot where travelers are finalizing plans but not yet locked into an OTA.

Example: Increase bids by 25% for same-day check-ins, where guests prioritize convenience over price, making direct bookings more atractive.

2. OTAs_ The demand aggregators

OTAs don’t create demand—they capture and monetize it, but hotels can strategically use them without becoming over-reliant. Optimize listings with high-quality images, mobile-friendly offers, and strategic promotions to improve ranking in OTA algorithms. Leverage the “Billboard Effect” by ensuring your website is compelling enough to convert OTA visitors into direct bookers through better perks, exclusive loyalty rates, and retargeting ads. Avoid price wars with OTAs by offering value-added incentives (e.g., free upgrades, flexible cancellation) instead of discounts. Diversify distribution by analyzing which OTAs bring high-value guests (longer stays, higher ADR, lower cancellations) and shifting reliance from dominant OTAs. Slowly transition OTA guests to direct bookers by using personalized post-stay emails, front-desk education, and loyalty incentives to encourage future bookings through your website.

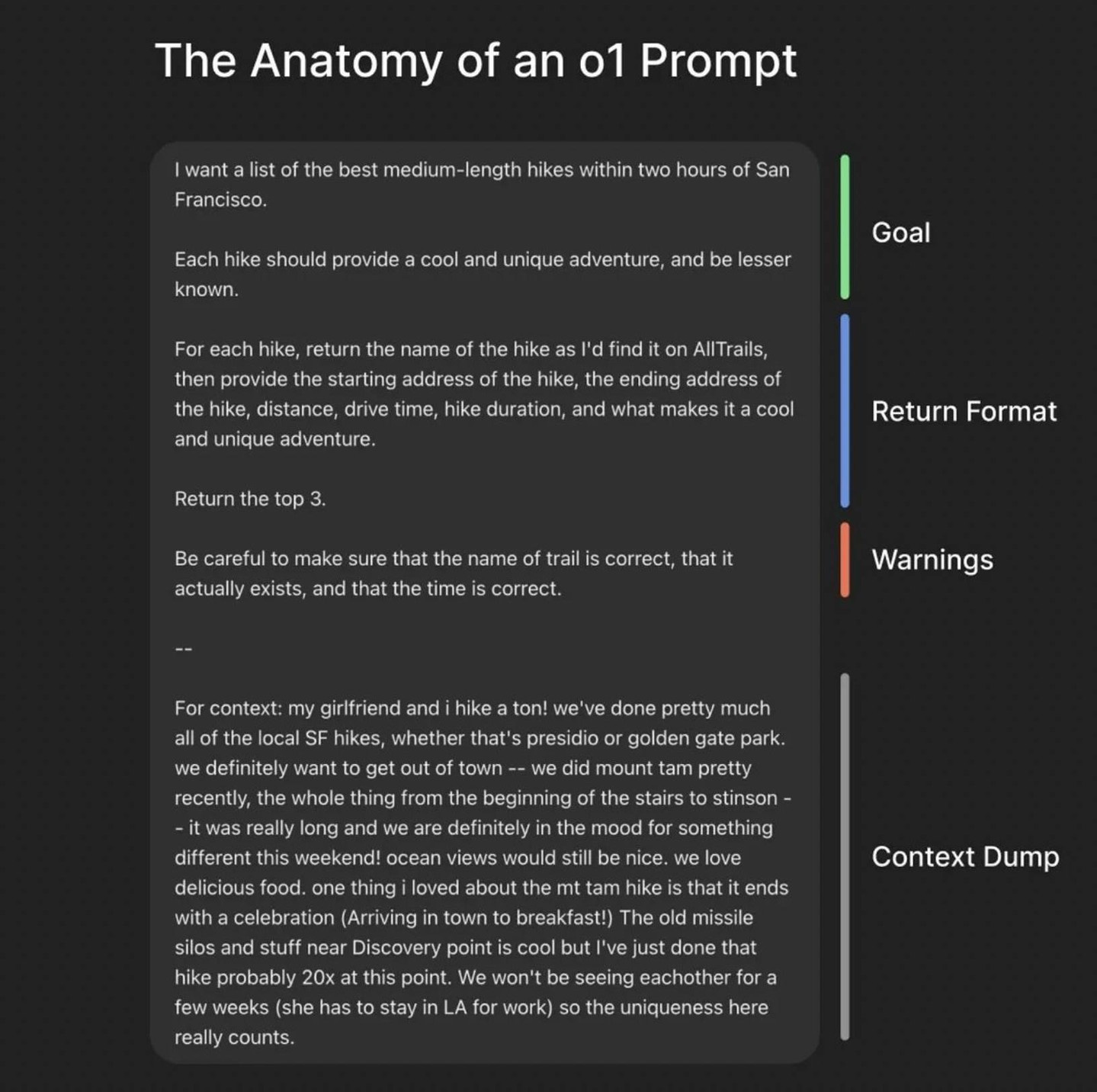

🚀THE AI CORNER

The ultimate framework for prompts (even OpenAI’s president, Greg Brockman, shared it)

📚 INTERESTING READS

U.S. Hotel Industry Growth: The U.S. hotel industry reported positive year-on-year growth for the week ending February 15, 2025. Overall occupancy increased by 1.2%, Average Daily Rate (ADR) rose by 2.2%, and Revenue per Available Room (RevPAR) was up by 3.4%.

Super Bowl Impact: New Orleans, which hosted Super Bowl LIX, saw significant increases in ADR and RevPAR. In contrast, Las Vegas, which hosted the previous year's Super Bowl, experienced notable declines in occupancy, ADR, and RevPAR1.

Cygnett Hotels Expansion: Cygnett Hotels & Resorts expanded its presence by opening the Cygnett Inn Airport in Jaipur on February 24, 2025.

🔍 UPCOMING POSTS:

📌 "The science of demand: How Hotels can proactively attract and capture more guests"

Discover data-driven strategies to generate and capture demand, reduce OTA dependency, and optimize direct bookings for maximum profitability.

🎯 "Psychology of booking: The hidden triggers that make travelers choose one Hotel over another"

We’ll explore proven UX and CRO strategies that drive conversions, featuring real-world insights from Airbnb’s booking flow experiments and user behavior analysis.

If you're an expert in any of those fields and would like to collaborate, drop us a line! We're always looking for industry leaders to share valuable insights, case studies, and innovative strategies with the hospitality community.

🌍UPCOMING EVENTS

ITB Berlin 2025 (March 4-6, Berlin, Germany)

The world's leading travel trade show, bringing together the global travel industry. It features exhibitions, professional conventions, and networking opportunities for tens of thousands of visitors, exhibitors, and media representatives.International Hotel Technology Forum Europe

This forum brings together over 400 industry leaders and decision-makers from top hotel chains across Europe to discuss the latest trends and technologies in the hospitality sectorPricing & Revenue Management Summit

Leading professionals from global brands attend this summit to share experiences and discuss the latest trends in pricing and revenue management for the hospitality industry.

FHT Paris – Smart Hotel

A unique hospitality exhibition in Paris dedicated to digital services in the hotel and restaurant industry, catering to technology suppliers, start-ups, and industry experts

🙏 Thanks for reading Hotel Industry Insights!

Join 9,988 hoteliers already transforming their businesses with innovative, practical strategies.

💡 Found this edition valuable? Show some love by hitting the ❤️ and sharing it with colleagues, friends, or on social media!

🤝 Want to showcase your company to 9,000+ hospitality decision-makers? Learn more here.

Thnaks for sharing it

Thanks, really enjoyed it.